Understanding Customer Order Terms

By Ron Lawrence May 1, 2012

There is a lot that happens behind the scenes when you log a customer order. Most of these things, however, can be categorized as financial transactions or inventory transactions. Understanding how the terms affect your finances and your inventory can be helpful in deciding the terms you offer to your customers. More importantly, it gives you a better idea of what to expect based on the terms you have entered.

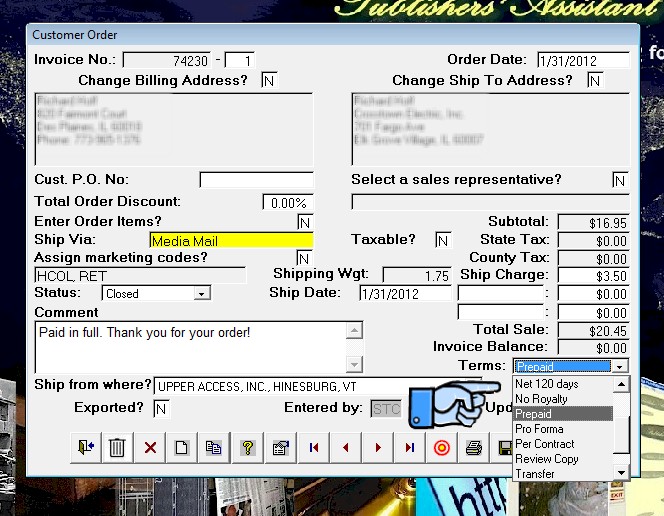

The available terms of sale listed on the customer order screen has grown over the years. So, it seems appropriate to document the current list of terms and what they do in the way of posting financial and inventory transactions. The following table summarizes the terms and actions taken for a customer order based on the terms selected.

|

|

|

Finance |

Inventory |

|||

|

Terms |

|

Post Total |

Post Liabilities1 |

|

Move From |

Move To |

|

Consignment |

|

Yes |

No |

|

Local |

Consignment |

|

Net30 |

|

Yes |

Yes |

|

Local |

Released |

|

Net60 |

|

Yes |

Yes |

|

Local |

Released |

|

Net90 |

|

Yes |

Yes |

|

Local |

Released |

|

Net120 |

|

Yes |

Yes |

|

Local |

Released |

|

No Royalty |

|

Yes |

Yes2 |

|

Local |

Released |

|

Prepaid |

|

Yes |

Yes |

|

Local |

Released |

|

Pro Forma |

|

No |

No |

|

N/A |

N/A |

|

Review Copy |

|

No |

No |

|

Local |

Free |

|

Transfer |

|

No |

No |

|

Local |

Ship To Location |

1Note that while the action of the customer order screen may be to post liabilities, those liabilities will be posted only if the specific liability contracts (royalty, consignment, or commission) specify that the liability is due “when shipped”.

2Liabilities are posted for "No Royalty" terms but the royalty calculation will be skipped.

As you can see, most terms move inventory from the available local inventory to a released state—which means that the system no longer tracks that inventory. This is the most common treatment of inventory for ordinary sales. You may specify terms of Prepaid, Net30, 60, 90, or 120 days, but PubAssist essentially treats these terms the same way. A receivable transaction is logged and the inventory is released. These terms are used for most typical sales. Retail sales are generally prepaid. The Net terms are generally used when selling to a retailer, library, or other organization for which you have a prior agreement about when you can expect payment.

“No Royalty” is treated pretty much the same way too, but the royalty calculation is skipped—even if the royalty is not due until the items are paid for.

“Pro Forma” terms will NOT produce a receivable, and will NOT ship any inventory. It’s an invoice “in form” only. Pro Forma invoices are useful for producing an invoice that represents a commitment to sell at a given price; but for which you don’t want to take any action yet. When the customer commits to the sale, you can change the terms to something else, and the invoice will then be processed according to the new terms.

“Review Copy” is generally used when you send out review copies. Generally, these invoices show a discount of 100%; however, there is nothing stopping you from charging something for a review copy.

By the way, any item that is sold at 100% discount is moved into a special released state called “Free”. It doesn’t matter what the terms are. This is done because the normal released state is used to calculate royalties that are based on the number of a title that has been previously sold.

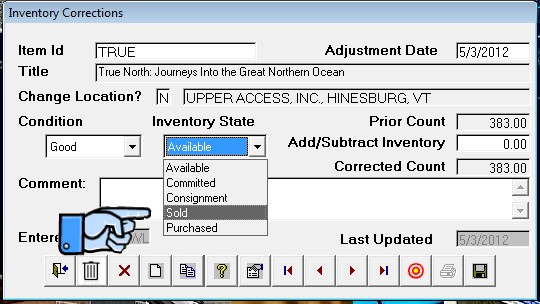

If you are just starting out with PubAssist, and you have previous sales for a title, you can enter an inventory correction for those prior sales by using the “Sold” inventory state.

If you are just starting out with PubAssist, and you have previous sales for a title, you can enter an inventory correction for those prior sales by using the “Sold” inventory state.

“Consignment” and “Transfer” terms are the most interesting and complex. These are used for handling consignment customers and distributors. In both cases, the expectation is that you will not be paid until your customer has resold your books. There is an overlap in function but there are subtle differences between these two cases. It’s worth sharing that the “Consignment” terms were implemented in the early days of PubAssist, whereas the “Transfer” terms are a fairly recent development.

In the case of “Consignment” terms, PubAssist actually logs the receivable. Inventory is moved into a special “Consignment” state at the ship to contact’s location. You can then run a Consignment Inventory Status report to see the quantity and location of your inventory that has been shipped out on consignment. When a receipt is logged against these invoices, the inventory is released from that consignment state and location. Amazon.com has traditionally been a classic consignment customer. Their terms have been straight forward and so tracking consignment sales to Amazon has worked quite well for many years.

Distributors, like Midpoint and NBN, however, are another matter. The terms they offer are typically payment 120 days AFTER they have sold your books, but they take immediate credit for returns. They also frequently charge for other services and hold some of what they owe you in reserve as a further hedge against returns. This makes tracking what they owe you difficult. The solution lies in treating them like a warehouse. That’s where the “Transfer” terms are used.

A “Transfer” invoice will NOT create a receivable. It also doesn’t release the inventory. It simply transfers it from your local inventory to the ship to contact’s location—where it remains as “available” inventory. When you generate an “Available Inventory Status” report, you will see your available inventory in multiple locations. You would use this same function if you have a multi-warehouse operation.

Later on, when your distributor tells you that they have sold some of the books you sent them, you will log another invoice with “Net120” terms. That invoice should specify the distributor’s location in the “Ship From” field. That will release the inventory from the distributor’s location—rather than your local warehouse. It will also create a receivable for what they have sold. So, this is a real receivable. Even if they underpay you for those sales, you will have an accurate accounting of what they owe you. You will also know exactly what they still have in inventory.

This brief explanation is covered in more detail in the article, Working with Distributors.

If you think about it, you can use the same treatment for Amazon that you use for your distributor. The Consignment invoice is not as flexible, but is perhaps easier to use. The use of separate Transfer and Net invoices provides the flexibility needed to handle your distributors. It will accomplish the same thing for a consignment customer, but requires more steps to complete. Still, you may decide that it is better to handle your major customers in the same way.

Well, I think that pretty much covers the terms on the customer order screen. I hope this explanation helps you to better understand these terms, and which to apply in a given situation.

Follow conversations with Ron on SPANNet.org.

Follow conversations with Ron on SPANNet.org.

Proud participant in Microsoft Visual FoxPro Forum at Tek-Tips

Proud participant in Microsoft Visual FoxPro Forum at Tek-Tips