Using Publishers' Assistant to Prepare my Income Tax Return

Submitted by Ron Lawrence

January 5, 2012

Well, it's that time of year again. Are you ready to do your income taxes? I think for most of us, it's a chore that we'd rather put off as long as we can. I thought it might be helpful to tell you how I use PubAssist to prepare the business portion of my tax return. I'm a sole propietor, so I report my business income and expenses on Schedule C of my 1040 Tax Return. I have owned a corporation in the past, however, and prepared my own tax returns. The process for preparing the 1120 return is basically the same with a few added hoops to get the Balance Sheet to, well... balance.

I'm going to cover the basics here. Before I dive in, it's important that I tell you that I am NOT a certified accountant. I have worked with accountants and bookkeepers over many years now and have tried the make the things that were requested by these professionals available in PubAssist. I will also share with you that for many years now, I have used TurboTax to prepare my taxes. I don't know if you can call that an endorsement, but I feel comfortable that it is fairly thorough in its process of leading me through all the considerations for my taxes.

Finally, one thing you should know up front is that I use the “Cash” method of accounting for preparing my tax return. Your accountant may advise you to use the “Accrual” method. There may be some advantage to the latter, but I like to keep things simple. I don’t report income until I have received it; and I don’t report an expense until I have paid it.

One of the things I found to be helpful is a checklist. It's a list of all of the things that are specific to my family's finances that I will need to prepare my tax return. There are generic checklists available. I think TurboTax may have one; but I would encourage you to develop your own that is specific to your own situation. I developed mine after several years of preparing my books for my tax preparer. Once you pull the necessary information together, doing your taxes is actually pretty straight forward. This is what my list looks like:

Income Tax Check List

Business Income & Expenses (Schedule C)

- Business Income from PubAssist “Accounts Received” report

- 1099-Misc from Upper Access Publishing

-

Business Expenses from PubAssist “Payment History by Account” report

- Import Credit Card charges into PubAssist

- Check for cash receipts or expenses paid with personal credit card

- Back out personal expenses from Sprint, Comcast

- Payroll expenses from Bookkeeper

Personal Income

- Kath’s W2 or December pay stub.

- Interest income from 1099-INT or December Credit Union statements.

- Dividends, Stock sales

- State income tax refund from 1099 or previous year’s return.

- Other income

Personal Deductions (Schedule A)

- Medical deductions rarely work out, but it’s worth a quick review.

-

Taxes Paid

- State Taxes from previous year’s return

- Property Tax from Essex bill

- Property Tax from Jericho bill

- Water Tax from Village of Jericho tax bill

- Vehicle registration fees

- License renewals

-

Charitable contributions.

- Charity from PubAssist “Payment History by Account” report

- Charity from Covenant Church statement

- Mortgage interest paid from Bank

- Mortgage interest paid from CU December statement

Education Credits (form 8863)

- From college bills or 1098-T statements

Other

- Student Loan Interest from VSAC

- Half of Self Employment Tax

- IRA deductions

If you are like me, you might be a little overwhelmed by this list. Keep in mind, that this is something I developed for myself over several years. When I ran into a new situation that required new information, I simply added it to the list—which turns out to be really helpful in the next year.

Most of these things are personal and have nothing to do with Publishers’ Assistant. Thus, this article is going to focus on the first section entitled, “Business Income & Expenses (Schedule C)”. Let’s walk through each item in the list.

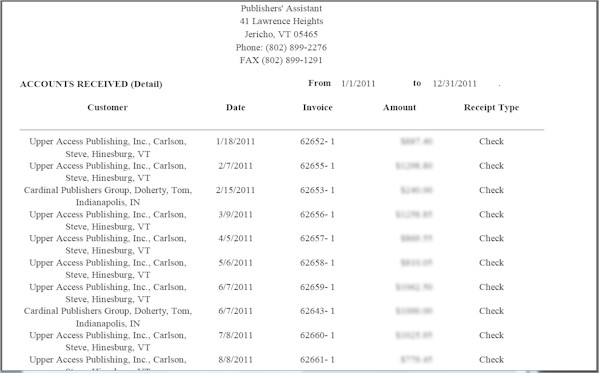

Business Income from PubAssist “Accounts Received” report

This is pretty straight forward. To get a complete picture of the cash that I have received over the year, I run the “Accounts Received” report from January 1st through December 31st. This is essentially a dump of all of the receipts I have logged over the year. The report will organize and subtotal your receipts by the receipt type.

Important! Make sure you do NOT include “Cancel Debt” receipts when reporting your business income for the year.

Important! Make sure you do NOT include “Cancel Debt” receipts when reporting your business income for the year.

Sorry if that seems a bit obvious, but it would be easy to take the bottom line and not check back to make sure you are not including receipts that you never actually received.

1099-Misc from Upper Access Publishing

The tax return specifically calls out income that has been reported on a 1099 form. So, you’ll want to separate out any income you receive from customers that pay you more than $600 a year, because they will likely report their payments to you on a 1099-Misc form.

I work with Upper Access in very much the same way that an author works with a publisher. So, one of the things I do each year is to check my income from Upper Access with their records. I have reason to do my taxes early each year. (If any of you have children in college and need to fill out financial aid applications, you will understand why.) Anyway, this is a step that allows me to check on the total before actually receiving the 1099.

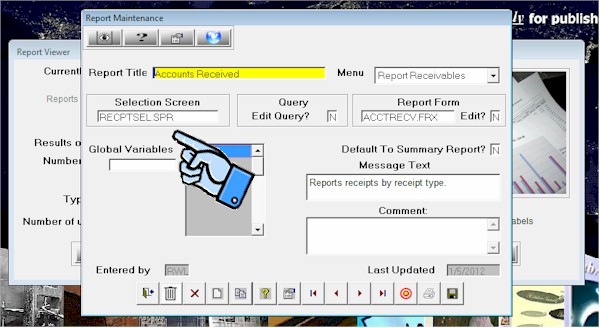

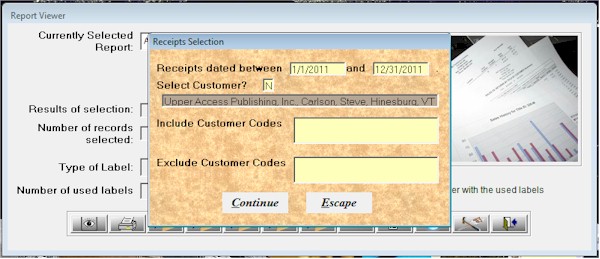

To do this, I use the same “Accounts Received” report, and select Upper Access as the customer to report only my receipts from them. Now, as I am writing this, I realized that the default selection screen for the Accounts Received report allows only the selection by a date range. There is, however, a selection screen for selecting receipts. It is fittingly named, RECPTSEL.SPR. You can specify this selection screen in the report maintenance screen. It looks like this:

Once you have specified this selection screen, the selection for the report should look like this:

Now you have a report to check against the 1099’s you receive from your biggest customers.

One more note on income: If you are using the “Accrual” method of accounting, you’ll want to print out the “Invoice List” report for the year. You’ll also want to print out the “Returns List” for the year. The invoice total less the returns total will give you your “Receivables” for the year.

Business Expenses from PubAssist “Payment History by Account” report

Reporting income is pretty easy. Reporting expenses can a bit more challenging because of the need to categorize your expenses. If you don’t know it already, PubAssist allows you to enter payments for any expense. The payment type field can be used to categorize these expenses for tax reporting purposes.

Import Credit Card charges into PubAssist

Before I report on my payments from PubAssist, I have some other work to do. At this point, I have to confess, that I can be pretty lazy when it comes to keeping track of all of the expenses associated with my business. So, one of the things I do is try to get most of my expenses on my business credit card. I keep a separate credit card for my business, and I try to pay may credit card off each month to minimize finance charges and interest. But, I let the credit card company do my expense tracking for me.

An interesting note here, I do track my payments to the credit card company in PubAssist throughout the year. So, I do always have pretty good data for my Profit & Loss report. But, I put off categorizing these expenses until tax time.

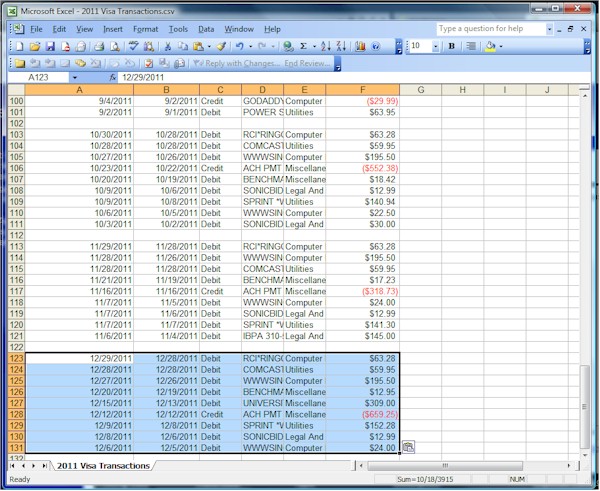

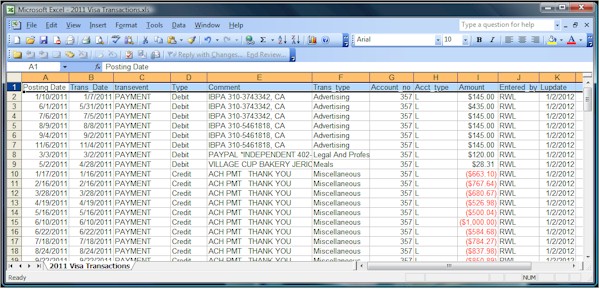

My credit card company has an online feature that allows me to download my transactions in CSV format. They even take a shot at categorizing these expenses for me. They are frequently wrong, but the categorization still helps me to prepare my taxes. So, at tax time, I complete the download process to make sure I have all of my credit card transactions for the year. I then load them into Excel. It looks something like this:

As I mentioned, the categories assigned by the credit card company are frequently wrong, but they are consistent. So, the next thing I do is to sort these transactions by category, and reassign the categories to ones I plan to report on my taxes. When I’m done, it looks something like this:

Now, I have an option available to me, that many of you do not. I can use Foxpro directly on my PubAssist database. So, the next thing I do is to change the headings of the columns to match my PubAssist LDGRTRAN fields, and import the transactions. You don’t have to do this.

If you want to get your credit card expenses into PubAssist, you need only to sum up the transactions for each category, and enter a single end-of-year transaction for each category as a payment.

If you want to get your credit card expenses into PubAssist, you need only to sum up the transactions for each category, and enter a single end-of-year transaction for each category as a payment.

If you need more information about how to do this, check out this article on our web site:

http://www.pubassist.com/articles/expenses.asp

Note that all of the above can be done by hand from your credit card statements. These days, however, it’s not unusual for your bank or credit card company to offer online services that will give you data rather than using your paper report. Using Excel makes it easy to rearrange your data and tally your expenses by category.

Whether you enter individual or summary transactions, if you take this step, then all of your expense categories can be entered into PubAssist.

Check for cash receipts or expenses paid with personal credit card

Another long-time practice has been to set up expense folders in my file cabinet. I have a general expense folder for ad-hoc expenses, like office supplies and online business purchases, that don’t fall into my regular business expense accounts. It has happened that I have grabbed the wrong credit card when I pay for an item, or it’s a small item which I pay for with cash. In any case, this item on the list is a reminder to me to go through my receipts to capture anything that was not logged into PubAssist and may have been paid for with personal funds, but is nonetheless a legitimate business expense.

Back out personal expenses from Sprint, Comcast

Since my office is in my home, some of my regular expenses contain personal portions. For example, I have a cell phone for business purposes, but it’s cost efficient to add my kids on to the same cell plan. O.K. I can already hear some accounts cringing out there, but this step is about dutifully and responsibly backing out any personal portion of my expenses from these bills.

Now, I generally add these adjustments to the same data I import for my credit card expenses. Once again, you can enter them as end-of-year adjustments as payments. Note that these payments will generally have a NEGATIVE amount, since you want to “debit” the expense category for the personal expense.

Payroll expenses from Bookkeeper

Publishers’ Assistant is a very small business, but I have taken on employees from time to time. I have done payroll in the past and decided that it is WAY more trouble than I want to get into. So, I have contracted with a local bookkeeping company that does my payroll and files all of the related returns to the various government agencies at a very reasonable cost. I love it!

Anyway, at the end of the year, although I may have logged the actual pay check that I issued, there are other payroll expenses that should be logged and reported: Employer contributions, Federal and state unemployment insurances, etc. Just as above, these expenses can be logged as payments with an appropriate category (payment type) for each.

Cost of Good Sold

I am in the software business. I don’t have inventory. But, of course, many of you do. So, it’s worth mentioning Cost of Goods Sold (COGS). PubAssist provides you with two ways to report your COGS. One is simple, and the other is quite a bit more complicated—but historically accurate.

If you purchase inventory only occasionally, then the simple method is probably best for you. The Cost of Goods Sold report in PubAssist will report the value of the inventory you have sold based on the FIRST title cost record associated with each of your titles. You can potentially have multiple title cost records which allows you to specify a schedule of costs to be used by the purchase order function of the program. but...

...understand that the Cost Of Goods Sold report will ONLY use the first title cost value to report the cost for each title.

...understand that the Cost Of Goods Sold report will ONLY use the first title cost value to report the cost for each title.

Most of our users know pretty well what the cost of the titles they have in inventory. So, this method works quite well them. Some, however, have many titles which they re-print many times—and each reprint may have a different cost. These people should use the second option for reporting COGS.

This second option depends on your purchase order history. If you have been loading your inventory into PubAssist by using the Inventory Correction screen, this method will NOT work for you.

There is no doubt that logging purchase orders is more work than logging inventory corrections. But reporting your COGS is only one good reason for doing so. There are others—the biggest, perhaps, is better visibility into your inventory pipeline.

While logging purchase orders may add to your record keeping work load, reporting an actual Cost of Goods Sold is very easy. You run the “Cost of Goods Sold from History” report. This report works by comparing your sales history with your purchasing history to report an actual cost for the items you sold.

Both the “Cost of Goods Sold” report and the “Cost of Goods Sold from History” report are in the Inventory Reports menu.

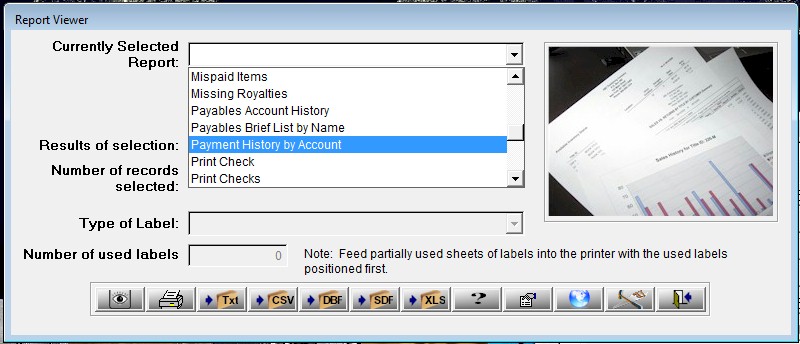

Reporting your Expenses

That pretty well completes the process of preparing my business expenses. When I have completed the above steps (excluding reporting Cost of Goods Sold) I can report all of my expenses by running the “Payment History by Account” report. This report is in the Payables Reports menu

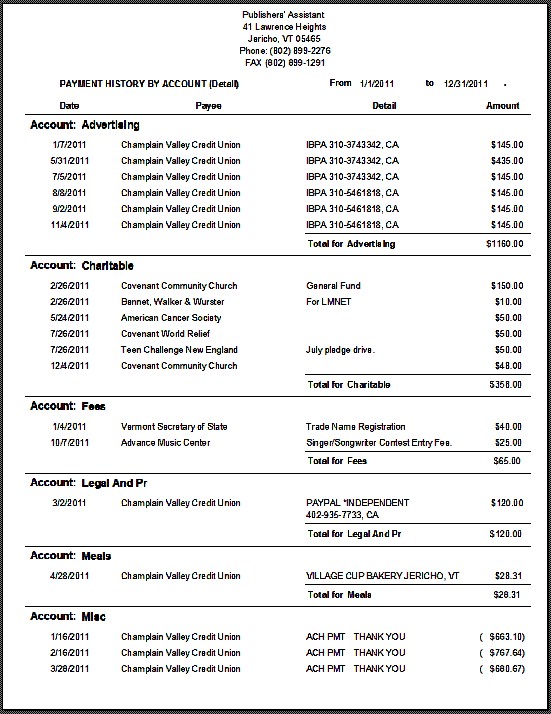

Here’s a partial snapshot of the report.

You can see that the detail version of the report will show every payment. It also provides a subtotal for each category or payment type. These categories are frequently referred to as “Accounts” in other accounting programs, so the term is used in this report as well. Using this report, I find it fairly easy to fill out the details needed for the business expenses portion of my Schedule C.

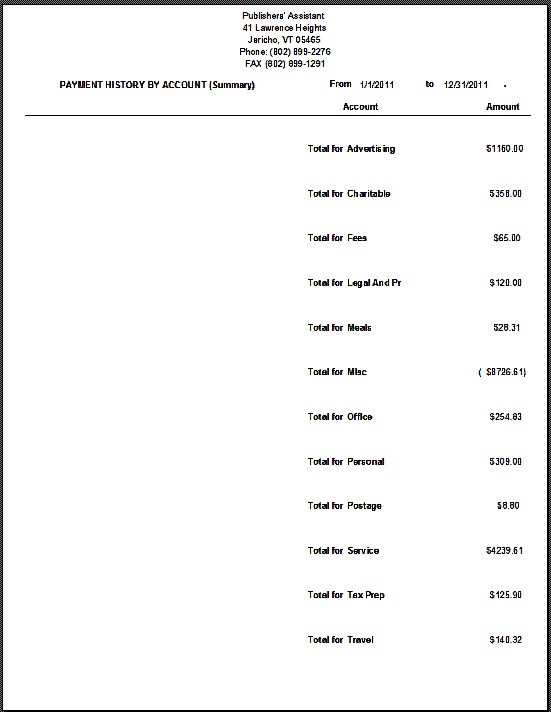

For the purposes of double-checking that I have included all expenses in my tax return, I find the summary version of this report to be helpful:

It frequently turns out that some of my expense categories are not appropriate to enter into my tax return. Still, it’s useful to see them listed.

Well, that concludes how I prepare to report my business income and expenses for my tax return. Writing this article has taken longer than it takes me to prepare the business portion of my taxes. I hope you find this explanation helpful. Any accountants out there that have further advice to offer, I would love to hear from you.

Follow conversations with Ron on SPANNet.org.

Follow conversations with Ron on SPANNet.org.

Proud participant in Microsoft Visual FoxPro Forum at Tek-Tips

Proud participant in Microsoft Visual FoxPro Forum at Tek-Tips